Defined Benefit Plans

When pension plan security and features meet your corporate objectives and your participant needs

Defined Benefit pension plans continue to represent a viable and

important retirement plan design for plan sponsors and their

participants in many industry and business sectors today. With the

flexibility of both traditional and hybrid plan designs, sponsors can

even more effectively meet the objectives of attracting and retaining

employees while at the same time effectively preparing their

employees for a stable retirement. Whether your plan is an active part

of your overall benefit offering, or if your plan is partially or fully frozen,

Bank of America Merrill Lynch can:

- Provide you with a flexible and comprehensive

- array of investment, administrative, actuarial and trust services that can ease the burdens of day-today plan management

- Offer efficient approaches to meeting emerging plan liabilities

- Better manage overall risk

- Provide participant services that help participants have a solid understanding and appreciation of the value of the benefits associated with your company's pension plan.

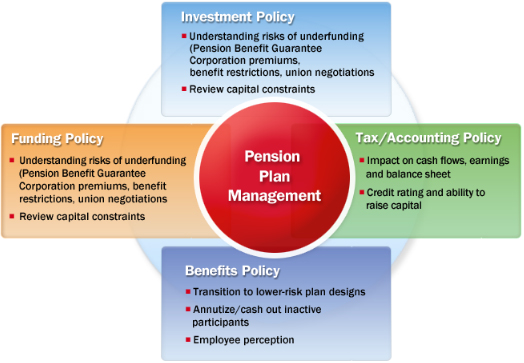

Pension risk and investment management

In managing your pension plan, there is no more critical connection

than the one between the actuarial assessment of future liabilities and

investment portfolio structure. We have unique capability to help you

take a connected view of your pension benefits and investment

strategy.

Your relationship manager and portfolio consultant will work with you, and outside resources that you may select, to help determine the best investment strategy for your plan. Together, our investment team and research group can provide:

Pension risk and investment management

In managing your pension plan, there is no more critical connection

than the one between the actuarial assessment of future liabilities and

investment portfolio structure. We have unique capability to help you

take a connected view of your pension benefits and investment

strategy.

Your relationship manager and portfolio consultant will work with you, and outside resources that you may select, to help determine the best investment strategy for your plan. Together, our investment team and research group can provide:

- Complete needs analysis

- Risk Posture assessments

- Plan liability analysis and modeling

- Plan liability analysis and modeling

- Provide participant services that help participants have a solid understanding and appreciation of the value of the benefits associated with your company's pension plan.

- Plan liability analysis and modeling

- Asset allocation recommendations

- Investment Policy Statement Development

- Economic analysis

- Market strategy

- Manager research and selection

- Performance measurement

- Portfolio monitoring

- Modeling and advice

25% of workers and retirees have no savings at all.* Are your employees prepared for the future?

See how Retirement and Benefit Plan Services can expand the possibilities of your employee benefit solutions.

1.877.895.2176